Deal Desk

Table of Contents

Table of Contents

What is a Deal Desk?

In fast-paced SaaS and enterprise sales, handing approvals, special pricing, custom terms, and risk reviews can slow down deals and cause friction between teams. That’s where a deal desk comes in.

A deal desk is a centralized, cross-functional team that supports the sales organization by managing and approving complex or non-standard deals to ensure they align with business objectives, protect margins, and accelerate time-to-close.

While the traditional view of a deal desk focused primarily on legal and accounting oversight, today’s SaaS and enterprise deal desks are more dynamic. They typically bring together stakeholders from:

Revenue and Sales Operations – to streamline workflows and maintain forecast accuracy

Finance and Accounting – to safeguard margins and validate revenue impact

Legal – to review contract terms, minimize risk, and ensure compliance

Product and Engineering – to assess feasibility of custom solutions or integrations

Customer Success and Delivery – to evaluate post-sale resource needs

Executive Leadership – for strategic deal approvals

Rather than acting as a bottleneck, the modern deal desk empowers sales teams by providing strategic deal guidance, surfacing risks early, and enabling faster, more profitable decision-making. Having a deal desk is becoming increasingly common in SaaS and enterprise companies as they grow and expand their revenue operations. Having a dedicated team of experts to handle contracts helps avoid potential problems and ensures that all deals are fair and advantageous for the company.

Synonyms

- Deal support

- Sales deal desk

- Pricing deal desk

- Contract management team

Deal Desks in a Digital-First Sales Environment

The role of the deal desk is evolving rapidly, especially in SaaS and enterprise sales environments where deal complexity, buyer expectations, and the need for transparency are increasing. Once focused mainly on reviewing contracts and approving or rejecting deals, modern deal desks now play a more strategic role throughout the entire sales cycle.

Today’s deal desks work closely with sales teams to understand customer needs, shape negotiation strategies, and provide guidance on pricing and contract terms. As a result, they’re centralizing decision-making, enhancing cross-functional collaboration, and ensuring deals are not only compliant but also optimized for profitability and customer value.

This shift is being accelerated by digital deal transformation—the use of digital tools and automation to streamline and modernize the deal-making process. By automating repetitive tasks, providing real-time visibility into deal progress, and enabling faster collaboration between departments, digital transformation empowers deal desks to operate more efficiently and strategically.

For revenue leaders, this means faster deal cycles, improved win rates, and more scalable sales operations—all while maintaining control over risk, margin, and compliance.

Let’s review the deal desk process in detail.

Overview of the Deal Desk Process

For Revenue Operations leaders, the deal desk process represents a structured, cross-functional workflow designed to accelerate complex deals, maintain pricing and policy compliance, and optimize deal profitability. A well-executed deal desk process brings together sales, finance, legal, operations, and product teams—reducing friction while ensuring every deal aligns with strategic business goals.

While traditionally viewed as a series of approvals, modern deal desk processes are more dynamic and integrated. Below is a comprehensive breakdown of each stage:

1. Deal Intake and Triage

Before a deal reaches the core review stages, an intake process helps determine whether the opportunity requires deal desk involvement. This may include:

- Automated triggers (e.g., discount above threshold, custom terms)

- Intake forms detailing opportunity size, deal complexity, and urgency

- Tiered support levels for standard vs. strategic deals

This step enables the deal desk to prioritize high-impact deals and manage internal workload more effectively.

2. Identifying the Deal Opportunity

The process begins when a sales representative identifies a deal worth pursuing—typically one that involves non-standard pricing, complex configurations, or strategic significance. The opportunity is recorded in the CRM or Configure Price Quote (CPQ) system and tagged for deal desk attention.

Early identification gives Revenue Operations visibility into emerging pipeline trends and resource needs, helping to align forecast models with real-time activity.

3. Qualifying the Deal

At this stage, the deal is evaluated to determine if it aligns with qualification criteria, including:

- Fit with ideal customer profile

- Budget and decision-making authority

- Timeline and urgency

- Strategic value or risk exposure

RevOps plays a central role by defining these criteria, embedding them in sales workflows, and ensuring consistent application across the organization.

4. Deal Structuring and Strategy

Before formal approvals, the deal desk collaborates with the sales team to develop a winning, compliant structure. This includes:

- Pricing scenario modeling

- Discount strategy aligned with margin targets

- Contract term evaluation (e.g., multi-year deals)

- Commercial term negotiation support

This stage transforms the deal desk from a gatekeeper into a strategic advisor—empowering sales while protecting the business.

5. Routing for Internal Review and Approval

Once structured, the deal is routed to relevant stakeholders for approval. This typically includes:

- Finance for margin, payment terms, and revenue impact

- Legal for contractual compliance and risk

- Product or engineering (if customizations are involved)

- Leadership (for large or high-risk deals)

Revenue Operations ensures the process is efficient and traceable, often automating routing and notifications through CPQ or workflow tools to reduce delays and avoid bottlenecks.

6. Closing the Deal

With approvals in place, the sales team moves to finalize the agreement. This includes:

- Contract signature via e-signature tools

- Booking the order in the CRM or ERP system

- Notifying fulfillment, billing, and onboarding teams

RevOps ensures seamless handoff to post-sales functions, maintaining data accuracy and alignment for smooth revenue recognition and customer onboarding.

7. Post-Deal Analysis and Optimization

After the deal closes, the deal desk and RevOps conduct a retrospective analysis to understand what worked—and what didn’t. This stage includes:

- Margin and profitability review

- Process efficiency evaluation (e.g., approval cycle time)

- Identification of recurring exceptions or custom requests

- Insights to inform future pricing, packaging, and enablement

Continuous feedback from this stage helps improve sales processes, refine approval logic, and surface strategic opportunities for growth and efficiency.

The deal desk process is more than a set of approvals—it’s a revenue engine. When designed thoughtfully, it empowers sales teams to move quickly, ensures financial rigor, and enables leadership to make data-driven decisions. For RevOps leaders, owning and optimizing this process is key to scaling predictable and profitable growth.

How Deal Desks Help Sales and Finance

Deal desks are at the intersection of sales strategy and financial governance. By centralizing deal review, pricing decisions, and approval workflows, deal desks bring greater control, consistency, and visibility to complex deal-making processes. Their impact is especially significant across both sales organizations and financial operations.

Impact on Sales Organizations

For sales teams, deal desks streamline the selling process by removing ambiguity and offering structured support. As a strategic partner to sales reps, the deal desk ensures that deals align with company policies, pricing guidelines, and customer value expectations. This empowers salespeople to move faster and more confidently through the sales cycle.

Deal desks also help standardize the approval process for non-standard deals, such as those involving custom pricing, terms, or packaging. Rather than navigating layers of internal communication, sales reps can rely on the deal desk for swift decision-making and negotiation support. This reduces friction, shortens sales cycles, and improves win rates—especially in enterprise and complex B2B environments.

Moreover, deal desks play an essential role in risk management. By thoroughly vetting each opportunity, they help the sales team avoid unprofitable or risky deals and maintain pricing discipline, especially in competitive or high-volume sales environments.

Impact on Financial Operations

From a finance perspective, deal desks ensure that every closed deal aligns with broader business objectives, revenue goals, and profitability metrics. They serve as a financial checkpoint—validating margins, discount thresholds, payment terms, and compliance with accounting standards.

This function enhances revenue predictability and protects against margin erosion. Finance teams benefit from increased visibility into deal structures, enabling more accurate forecasting and better alignment between revenue recognition and financial planning.

Deal desks also contribute to better data quality by enforcing standardized processes and capturing critical financial data consistently across deals. This reduces errors in billing, reporting, and compliance while enabling finance leaders to make informed strategic decisions based on clean, reliable data.

Ultimately, deal desks bridge the gap between sales ambition and financial rigor, creating a more cohesive, accountable, and data-driven revenue operation.

The deal desk can be defined as “a central team within an organization that is responsible for approving or disapproving deals.” The main function of a deal desk is to review and approve or reject deals. This helps to ensure that the organization is getting the best possible return on investment and that deals are in line with organizational strategy. A deal desk can also help to optimize resources by identifying when and where discounts can be applied. This can free up salespeople to focus on other tasks such as building relationships with customers and generating new leads.

A deal desk can also be a valuable tool for managing risk. By reviewing and approving or rejecting deals, deal desks can help to prevent organizations from becoming involved in deals that are not in their best interests.

How to Optimize Your Deal Desk for Maximum ROI

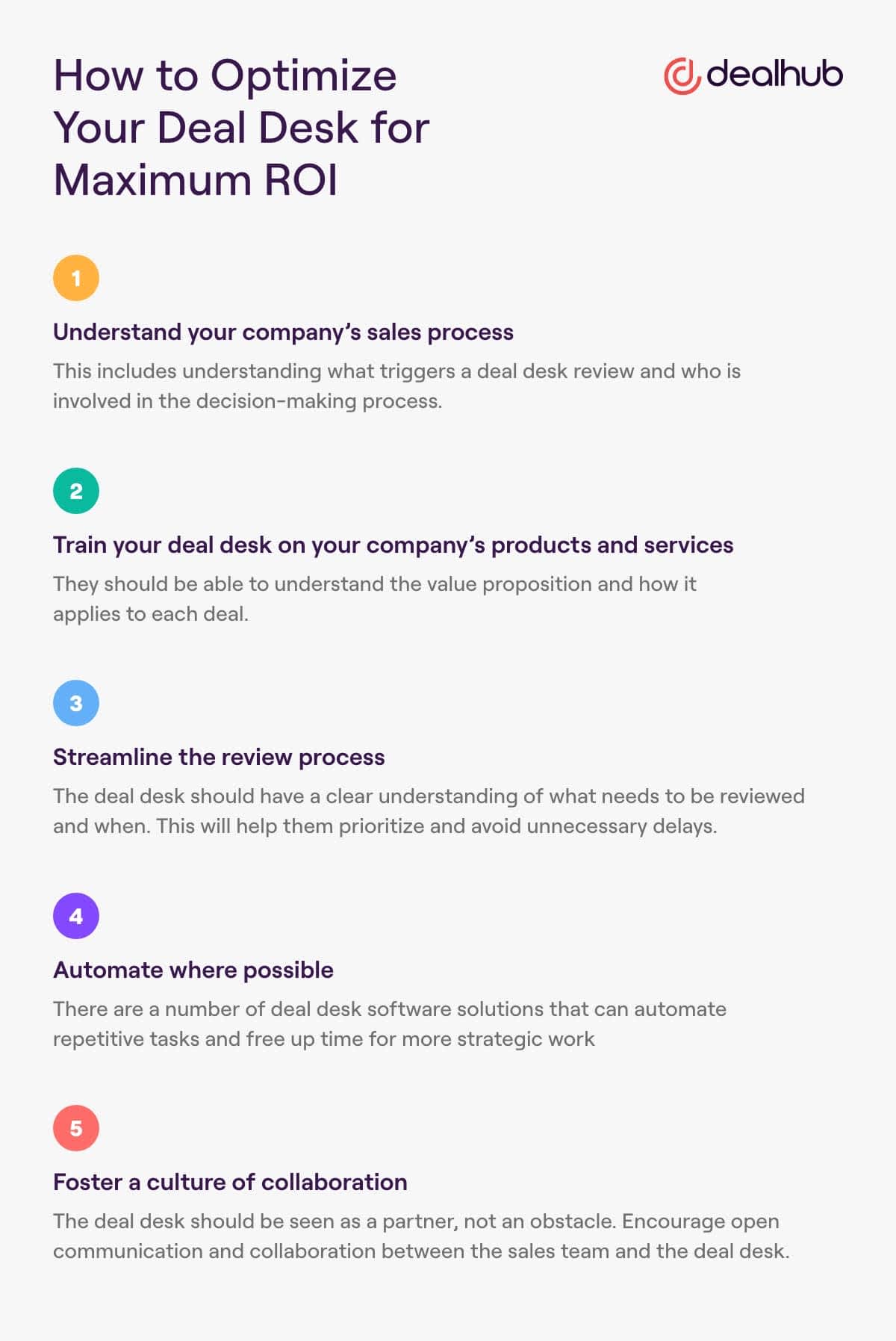

If your deal desk isn’t optimized, you’re likely missing out on opportunities and leaving money on the table. SalesHacker outlines these steps to maximize the effectiveness of your deal desk:

- Understand your company’s sales process

This includes understanding what triggers a deal desk review and who is involved in the decision-making process.

- Train your deal desk on your company’s products and services

They should be able to understand the value proposition and how it applies to each deal.

- Streamline the review process

The deal desk should have a clear understanding of what needs to be reviewed and when. This will help them prioritize and avoid unnecessary delays.

- Automate where possible

There are a number of deal desk software solutions that can automate repetitive tasks and free up time for more strategic work

- Foster a culture of collaboration

The deal desk should be seen as a partner, not an obstacle. Encourage open communication and collaboration between the sales team and the deal desk.

By taking these steps, you can optimize your deal desk for maximum effectiveness. As a result, you’ll close more deals and increase revenue for your company.

Reasons to Implement a Deal Desk

The deal desk is a vital part of sales operations, and its importance should not be underestimated.

Sales Efficiency

The deal desk is a crucial part of any sales organization. An effective deal desk increases sales efficiency by streamlining the deal approval process and providing transparency into the sales pipeline. This allows sales teams to focus on selling rather than on administrative tasks.

Customer Experience

A deal desk can also help improve the customer experience by ensuring that deals are processed quickly and efficiently. By providing visibility into the status of deals, customers can be kept informed of the progress of their orders.

Standardization of Processes and Tools

The deal desk is responsible for standardizing processes and tools across the company. This includes creating templates, workflows, and documentation to streamline the sales process. It also involves working with different departments to ensure that everyone is using the same systems and software. By standardizing processes and tools, the deal desk can help make sure that deals are completed efficiently and correctly.

The deal desk can also be a resource for salespeople, providing guidance on how to use the various tools and systems. By helping sales reps understand and use the standard tools and processes, the deal desk can help make sure that deals are completed quickly and efficiently.

Align Key Stakeholders and Business Units

The deal desk is the bridge between sales executives, multiple stakeholders, and business units. By aligning the interests of all parties, the deal desk ensures that everyone is working towards a common goal. This enables the company to make informed decisions and get the best possible results from its negotiations.

Timely Renewals

A timely renewal is defined as a renewal that occurs within the contractual period specified in the original agreement. This means that if your original contract stipulates that renewals must occur every six months, then a renewal that occurs within that six-month timeframe would be considered timely.

There are a few reasons why timely renewals are so important. First, they ensure that the deal desk has adequate time to prepare for the next round of negotiations. Second, they help to avoid disruptions in service levels or access to products and features. And finally, they help to keep costs down by preventing the need for last-minute rush orders or expedited shipping fees.

Manage Complex Deals

The deal desk is a critical component of any organization that relies on complex deals to drive revenue. By helping to manage and streamline the deal process, the deal desk can play a pivotal role in ensuring that these deals are successful.

There are a number of ways in which the deal desk can help to manage complex deals.

1. The deal desk can help to identify potential risks and issues associated with a deal. By doing so, the deal desk can help to ensure that these issues are addressed early on in the process before they have a chance to derail the deal.

2. The deal desk can help to negotiate terms and conditions with counterparties. By doing so, the deal desk can help to ensure that the terms of the deal are favorable for all parties involved.

3. The deal desk can help to monitor and track the progress of a deal. By doing so, the deal desk can help to ensure that the deal stays on track and is completed in a timely manner.

Agile CPQ for Deal Desk Pros

Deal Desk professionals shouldn’t weather storms unequipped. Our recent expert panel provides a comprehensive toolkit to support Deal Desks in their everyday operations and keep deals on course.

Learn how agile CPQ gets wind in your ‘sales’ process with pricing and operational efficiency, automated workflows, and a collaborative, transparent environment.

Watch the full panel event to see what agile CPQ can do for you

How Deal Desk Software Can Help You Close High-Value Deals

For sales organizations looking to close high-value deals, deal desk software, such as DealHub’s revenue hub, can be a valuable asset. However, the deal desk team is just as important as the tools they use. Here’s how deal desk teams and deal desk software are both essential in closing deals:

First, a deal desk team can provide valuable insights and perspectives that can help you win complex deals. They understand the buying process and can help you craft strategies that are tailored to the needs of your specific deal.

Second, deal desk software can give you a competitive edge by providing access to real-time market data and intelligence. This information can help you price your products and services more effectively and negotiate from a position of strength.

Third, deal desk software can help you manage and track your deals, keeping you organized and on track to close. This can save you time and help you avoid costly mistakes.

Fourth, deal desk software can automate repetitive tasks, freeing up your time to focus on more strategic tasks. This can help you close deals faster and improve your overall efficiency.

Finally, a deal desk team can provide valuable support during the implementation phase of a deal, ensuring that everything goes smoothly. This can help you avoid problems and ensure a successful outcome.

By providing insights, market intelligence, deal management, and automation, deal desk software helps sales organizations win complex deals and improve their overall efficiency.

Measuring Deal Desk Performance

Companies measure deal desk performance using several metrics that assess efficiency, effectiveness, and stakeholder satisfaction. Here are some key areas to consider:

Sales Velocity

- Deal Cycle Time: Tracks how long it takes to close deals after they reach the deal desk. Faster cycles indicate a smoother flow.

- Win Rate: Measures the percentage of deals that convert from opportunities to closed sales. A high win rate suggests the deal desk is effectively supporting sales efforts.

- Average Deal Size: Analyzes the typical value of deals being closed. Increasing size might indicate upselling success or targeting larger clients.

Efficiency

- Response and Resolution Time: Tracks how quickly the deal desk addresses initial inquiries and fully resolves issues. Faster times signify efficient operations.

- Error Reduction: Monitors the number of mistakes made during the quoting, contracting, or approval process. Lower errors mean smoother deal flow.

Financial Performance

- Cash Collection: Measures how quickly payments are received after deals close. Faster collections improve cash flow.

- Profitability: Analyzes the profit margin generated by deals managed by the deal desk. Higher margins indicate effective deal structuring.

Stakeholder Satisfaction

- Sales Rep Satisfaction: Surveys or interviews of salespeople are used to gauge their experience working with the deal desk. Positive feedback indicates good collaboration.

- Customer Satisfaction: Measures customer experience during the contracting and approval process. Happy customers are more likely to renew.

By tracking these metrics, companies can identify areas for improvement and optimize their deal desk operations. Additionally, some look at portfolio coverage (percentage of products offered that are being sold) and multi-product attach rate (how many products are sold per deal) to assess sales strategy effectiveness.

People Also Ask

What is a deal desk analyst?

A deal desk analyst is a professional who helps companies manage and monitor their business deals. A deal desk analyst can be responsible for a variety of tasks, such as reviewing and approving contracts, monitoring compliance with company policies, and providing support to sales teams. In many cases, a deal desk analyst will also have a background in finance or accounting, which can be helpful in understanding and negotiating business deals.

The role of a deal desk analyst is to help ensure that a company’s deals are beneficial and meet the company’s objectives. A deal desk analyst can be involved in all stages of a deal, from initial negotiations to post-transaction follow-up.

Where does a deal desk sit in an organization?

A deal desk is typically responsible for managing and negotiating commercial contracts on behalf of an organization. Typically, the deal desk will be part of the revenue operations, sales operations, legal, or finance department.

The specific responsibilities of a deal desk can vary from organization to organization. However, some common duties include: reviewing and approving proposed deals, negotiating contract terms, maintaining contract databases, and providing guidance to sales teams on contract-related matters.

What is the purpose of a deal desk?

The purpose of a deal desk is to support the sales team in closing deals. They do this by providing pricing guidance, approving discounts and promotions, and managing approvals for special terms and conditions. Deal desks are also responsible for ensuring that all deals comply with company policies and procedures. They are also integral in streamlining and improving the contract management process.

What is the importance of measuring deal desk performance?

Measuring deal desk performance is crucial for several reasons. It acts like a flashlight, illuminating areas where your deal desk is excelling and exposing weaknesses that need attention. Here’s how it benefits your business:

Improved Efficiency and Revenue:

– Faster Sales Cycles: By tracking deal velocity, you can identify bottlenecks and streamline processes, leading to quicker closures and more revenue generation.

– Reduced Errors: Monitoring errors in quoting, contracting, and approvals helps minimize delays and rework, saving time and resources.

– Optimized Resource Allocation: Data reveals if the deal desk is adequately staffed and equipped. You can then allocate resources efficiently to maximize its impact.

Enhanced Decision-Making:

– Data-Driven Strategies: Performance metrics provide a factual basis for improving sales strategy, pricing models, and deal structuring.

– Identifying Profitable Deals: Analyzing profitability allows you to focus on deals that generate the highest margins and avoid those that erode your bottom line.

Stronger Customer Relationships:

– Improved Customer Experience: Tracking customer satisfaction with the contracting process helps identify and address pain points, leading to smoother onboarding and fostering loyalty.

– Effective Communication: Metrics can highlight communication gaps between the deal desk and sales or customer success teams, allowing for better collaboration and a unified customer experience.

Overall Business Growth:

– Measurable Progress: By tracking performance over time, you can quantify the deal desk’s contribution to revenue growth, win rates, and overall sales effectiveness.

– Continuous Improvement: Performance data allows you to identify areas for improvement and implement changes for a more streamlined and efficient deal desk operation.

How do deal desks make sales teams stronger?

Deal desks are playing an increasingly important role in sales organizations. By centralizing all deal information and automating key processes, deal desks are helping sales teams close more business and improve their win rates.

Here are three ways that deal desks are making sales teams stronger:

1. Deal desks help sales reps close more business.

By centralizing all deal information and automating key processes, deal desks help sales teams close more business. Deal desks also help sales teams by providing visibility into the status of deals, so that they can follow up with customers and prospects in a timely manner.

2. Deal desks improve win rates.

In addition to helping sales teams close more business, deal desks also improve win rates. By automating key processes and providing visibility into the status of deals, deal desks help sales teams avoid last-minute surprises and ensure that they are always aware of the latest developments.

3. Deal desks help sales teams manage risk.

By centralizing all deal information and automating key processes, deal desks help sales teams manage risk. Deal desks also help sales teams by providing visibility into the status of deals so that they can identify and address potential problems.