Quote-to-Cash (Q2C)

Table of Contents

Table of Contents

What is Quote-to-Cash?

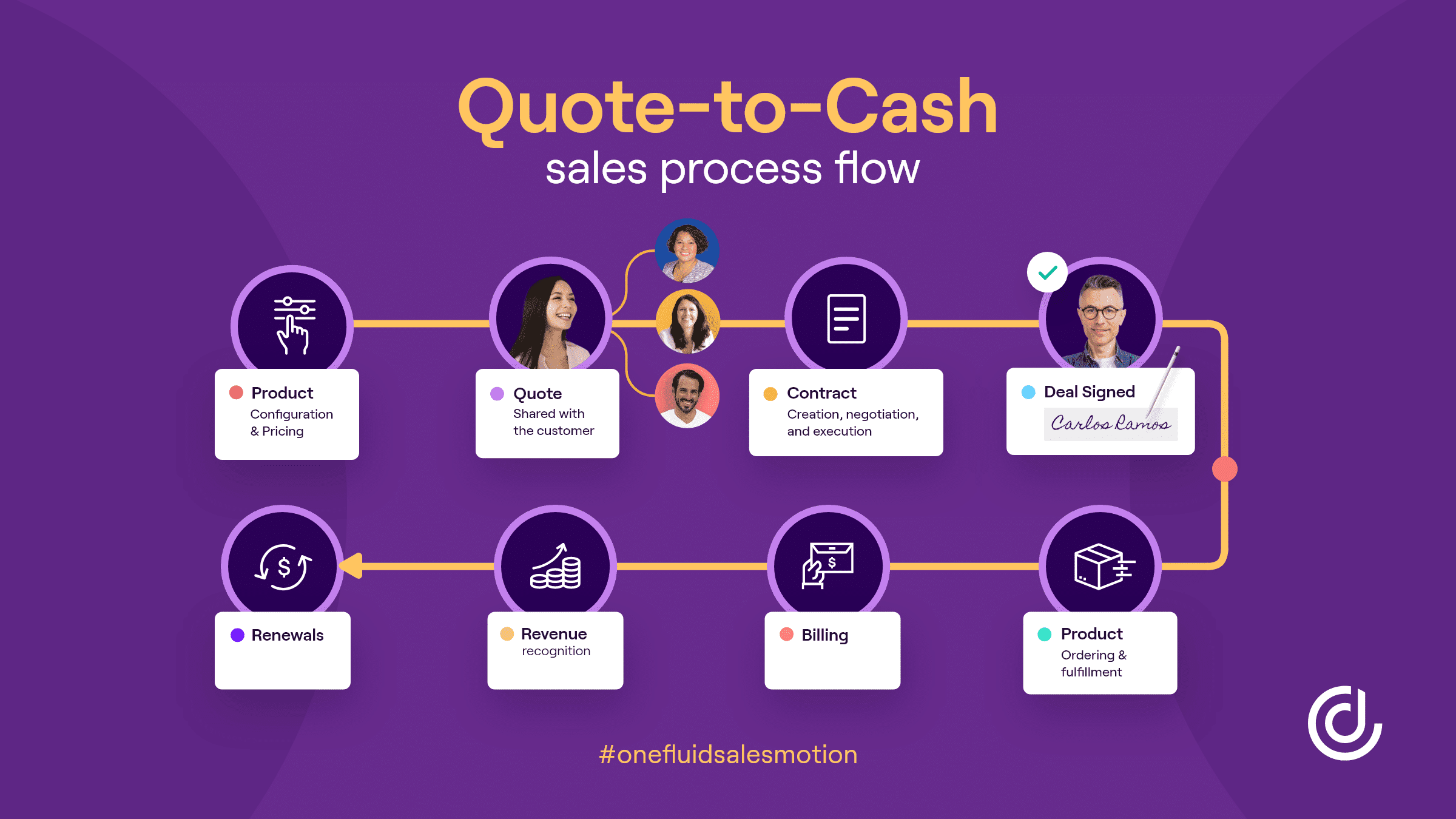

Quote-to-cash (Q2C or QTC) is a term that represents the entire sales cycle from product configuration and quote generation to closing the deal and managing revenue. It includes the following aspects of the sales process:

- Product configuration and pricing

- Sharing the quote with the customer

- Contract creation, negotiation, and execution

- Customer acceptance of the deal

- Product ordering and fulfillment

- Billing

- Revenue recognition

- Renewals

Synonyms

- QTC

- Q2C

- Quote to cash processing

Overview of the Quote-to-Cash Cycle

The quote-to-cash cycle is the end-to-end process that a company follows to convert a sales opportunity into actual revenue. It involves multiple stages, from the initial customer inquiry to the final payment, and is critical for ensuring smooth operations, accuracy, and timely revenue recognition.

A well-managed QTC cycle not only improves operational efficiency but also enhances customer satisfaction and cash flow.

Here’s a breakdown of the key stages in the quote-to-cash process:

Stage 1: Quote Generation

The cycle begins when a potential customer expresses interest in a product or service. Sales teams then generate a detailed quote that outlines the proposed products, services, pricing, and terms. Accurate and timely quote generation is essential to setting the stage for a successful transaction.

Stage 2: Negotiation and Approval

Once the quote is presented, negotiations may follow. This stage may involve discussions on price, discounts, payment terms, and service conditions. After negotiations, the quote is often sent for internal approval to ensure it aligns with company pricing policies and profitability goals.

Stage 3: Contract Creation and Finalization

Once both parties agree on the terms, a contract is created to formalize the deal. This legally binding agreement includes all agreed-upon terms and conditions. Efficient contract creation is crucial to avoid delays and ensure that all details are captured accurately.

Stage 4: Order Management

After the contract is signed, the order management system takes over to process and fulfill the order. This includes coordinating inventory, delivery, and any service fulfillment required. Effective order management ensures that customer orders are fulfilled accurately and on time.

Stage 5: Invoicing and Payment Collection

Once the order is fulfilled, the billing process begins. Accurate invoices are generated, reflecting the agreed-upon pricing, terms, and discounts. Timely payment collection follows, and businesses may employ automated reminders and payment tracking systems to ensure prompt payments.

Stage 6: Revenue Recognition

The final step of the QTC cycle is revenue recognition, where the company records the revenue in its financial systems. This step is important for accurate financial reporting and ensuring compliance with accounting standards.

Each stage of the quote-to-cash process is interconnected, with delays or inefficiencies in one area impacting the entire cycle. By optimizing each stage, businesses can reduce bottlenecks, improve cash flow, and enhance the overall customer experience.

Benefits of an Integrated Quote-to-Cash Process

An integrated Q2C process connects all stages of the revenue cycle through unified technology, creating a seamless flow from initial customer quotation to final payment collection. This end-to-end approach offers substantial advantages for organizations seeking to optimize their revenue operations.

Accelerated Revenue Recognition

By eliminating manual handoffs between departments and systems, an integrated Q2C process significantly reduces cycle times. Quotes move to orders faster, orders become invoices more quickly, and payments are processed and recognized with minimal delay. This acceleration can reduce the quote-to-cash timeline in many organizations.

Enhanced Customer Experience

When your Q2C process flows smoothly across a unified platform, customers enjoy a more coherent experience. They no longer need to navigate disconnected touchpoints or repeat information across different stages. Sales representatives can access complete customer information during negotiations, service teams can see order history when addressing inquiries, and billing becomes transparent and predictable.

Improved Data Accuracy and Visibility

Integration eliminates redundant data entry, dramatically reducing error rates in pricing, product configurations, and customer information. Decision-makers gain a comprehensive view of the entire revenue pipeline, enabling more accurate forecasting and strategic planning. This visibility extends to identifying bottlenecks, tracking key performance metrics, and optimizing areas with the highest potential for improvement.

Increased Operational Efficiency

Teams spend less time on manual reconciliation, data transfers, and exception handling when working within an integrated system. Automation can handle routine approvals, document generation, and payment processing, freeing staff to focus on value-added activities like relationship building and complex deal structuring.

Better Compliance and Control

A unified Q2C platform can enforce standardized processes, approval workflows, and pricing policies, reducing risk and ensuring regulatory compliance. Audit trails become more comprehensive, making it easier to track changes, justify decisions, and demonstrate adherence to internal and external requirements.

Unlocking Strategic Value

Perhaps most importantly, an integrated Quote-to-Cash process transforms revenue operations from a collection of tactical functions into a strategic asset. Organizations gain the agility to launch new products faster, experiment with innovative pricing models, and respond quickly to changing market conditions—all while maintaining operational excellence throughout the customer financial journey.

How to Improve the Quote-to-Cash Process

Improving the quote-to-cash process is crucial for ensuring efficiency, accuracy, and timely revenue recognition. A smooth quote-to-cash process can enhance customer satisfaction, reduce errors, and boost your bottom line.

Here are the essential ways Revenue Operations leaders can optimize the process:

Automate Repetitive Tasks

Automating manual tasks can significantly reduce errors and save time. Implement tools like CPQ (Configure, Price, Quote) software that integrates with your CRM and ERP systems to streamline quoting. Sales teams can quickly generate accurate, customized quotes based on up-to-date product and pricing information, which reduces the need for manual data entry.

Ensure Accurate Product Configuration

The configuration process is essential, especially for businesses that offer customizable or complex products. CPQ software allows sales reps to configure products according to customer needs and automatically adjusts prices based on these configurations. This step ensures that quotes are accurate and reflect customer requirements, minimizing discrepancies later in the process.

Streamline Communication Between Sales and Finance Teams

Clear communication between your sales and finance teams is crucial for smooth execution of the quote-to-cash process. Set up regular touchpoints to keep both teams aligned on the status of quotes, approvals, and customer requests. Ensuring transparency helps reduce misunderstandings, delays, and the back-and-forth that often occurs in the approval process.

Centralize Data Management

Centralized data management ensures that everyone has access to the most up-to-date information. Whether it’s pricing data, customer profiles, or product configurations, having a unified system for storing and accessing data makes it easier to generate quotes, track customer interactions, and ensure that finance has the correct information for invoicing.

Ensure Pricing Accuracy

Accurate pricing is essential for profitability and customer trust. Implement advanced pricing models and price optimization software to dynamically adjust prices based on factors like market trends, customer demand, and competitor pricing. Ensure that all stakeholders have access to real-time data to prevent pricing errors.

Integrate with Contract Management

Integration with contract management systems is a vital step to ensure that the terms agreed upon in the sales process are correctly documented. Automated contract generation can prevent delays, errors, and miscommunication. This integration ensures a seamless transition from quote approval to contract finalization, which is critical for streamlining the revenue cycle.

Simplify Order Management

After the quote is approved, the order must be processed efficiently. Automate the handoff from the sales team to the order management and fulfillment teams. Integration between systems like CPQ, ERP, and order management ensures that all necessary information (e.g., pricing, delivery details, product specifications) is transferred seamlessly and accurately.

Automate Invoicing and Payments

Once the order is processed, automate the invoicing and payment collection stages. By integrating invoicing systems with your CRM and ERP, you can generate accurate invoices that reflect the agreed-upon pricing and terms. Additionally, automating payment reminders and collections can improve cash flow and reduce administrative overhead.

Implement a Robust Approval Workflow

Setting up an approval workflow is essential to ensure that quotes, contracts, and discounts are properly vetted before going to the customer. Use automated approval processes to track and streamline approval steps, reducing bottlenecks and delays in getting deals finalized.

Monitor and Measure Performance

Track key performance indicators (KPIs) throughout the quote-to-cash process to identify areas for improvement. Metrics like quote-to-order conversion rates, time to close, and order accuracy can provide valuable insights into bottlenecks or inefficiencies. Regularly review these KPIs to adjust your strategies and improve performance.

Manage Customer Expectations and Communication

Throughout the quote-to-cash process, maintaining clear communication with the customer is key. From the initial quote to the final invoice, ensure that the customer is kept informed about progress, changes, or delays. Providing timely updates and proactive communication can help build customer trust and satisfaction.

Leverage Data for Insights and Continuous Improvement

Use data from each stage of the quote-to-cash process to gain insights into your business operations. Data analytics can help you identify trends, customer preferences, and potential bottlenecks, allowing you to fine-tune your processes. For example, monitoring pricing patterns can help you optimize pricing strategies, while sales cycle data can reveal opportunities for improving sales efficiency.

Implementing these changes will streamline your workflow and help meet your revenue goals, ultimately boosting your bottom line.

Streamlining Quote-to-Cash with Technology

While Q2C processing is a crucial part of many businesses’ sales processes, it can also be time-consuming and complex. There are several different software solutions available that can help streamline quote-to-cash processing, making it easier for your business to manage customer orders efficiently and with minimal hassle.

Some key features to look for in quote-to-cash software solutions include the ability to automate quote creation and delivery, the ability to integrate seamlessly with your existing sales and billing systems, and the ability to scale easily as your business grows. Other useful features may include tools for managing customer quote approval workflows, analyzing quote conversion metrics over time, or tracking and reporting quote-to-cash progress across different teams or regions.

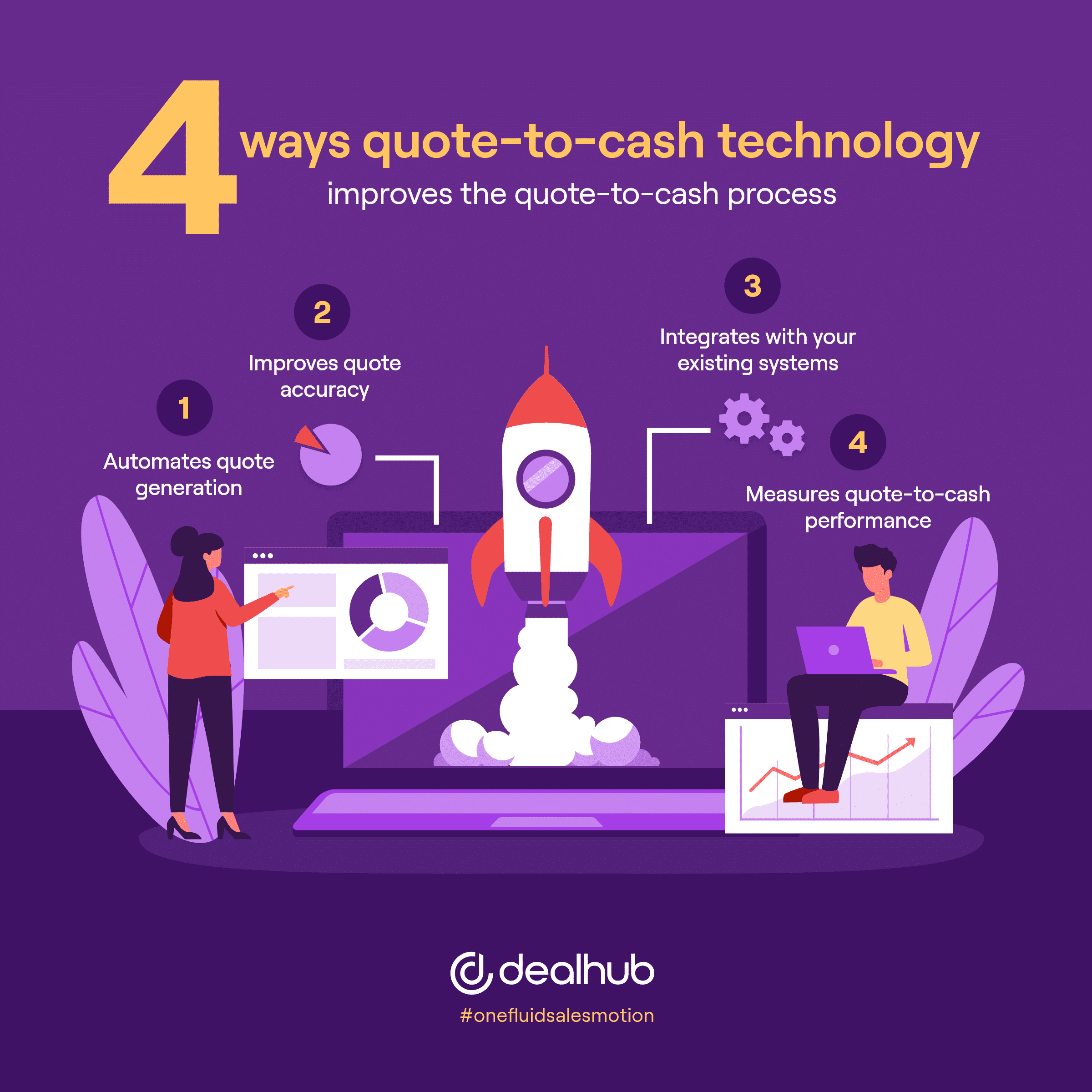

There are many quote-to-cash solutions on the market, so it is important to do your research and select the one that is right for your business. The following are four ways quote-to-cash technology improves the quote-to-cash process and helps businesses grow revenue. Look for a solution that has these capabilities:

1. Automates quote generation

One of the main benefits of using quote-to-cash software is the ability to automate quote generation with CPQ software. This can save sales reps a significant amount of time, as they no longer need to manually create quotes.

2. Improves quote accuracy

Another benefit of using quote-to-cash software is that it can help to improve quote accuracy. This is because the software can automatically populate quote details based on customer information, order details, and other data sources.

3. Integrates with your existing systems

Many quote-to-cash solutions integrate with other business systems, such as CRM platforms, fulfillment systems, and accounting software, to provide an end-to-end solution. This ensures various parts of the system are communicating, orders are shipped in a timely manner, and accurate data is available to revenue operations teams.

4. Measures quote-to-cash performance

Finally, it is important to measure the performance of your quote-to-cash solution. Accurate data from all touchpoints in the quote-to-cash system will help identify areas where the solution is working well and areas where there is room for improvement. Using data-driven insights, you can make changes to optimize quote generation and increase quote-to-cash efficiency.

Quote to Cash vs. CPQ

There are notable differences between quote to cash (Q2C) and configure price quote (CPQ) processes. Perhaps the most significant difference is that CPQ generally encompasses a broader range of activities than Q2C. While Q2C focuses primarily on the financial aspects of closing a deal and generating revenue, CPQ also includes other essential steps, such as configuring products or services and creating pricing proposals.

Another difference between Q2C and CPQ is that the former is typically more manual and time-consuming than the latter because CPQ systems often come with built-in automation and workflow capabilities that can help streamline the entire process.

Finally, it’s worth noting that Q2C and CPQ are not mutually exclusive; in many cases, organizations will use both processes to ensure a smooth and efficient sales cycle. However, depending on the specific needs of a business, one process may be more suitable than the other.

Ultimately, the difference between quote to cash and configure price quote comes down to scope and automation. CPQ is generally more comprehensive and automated than Q2C, making it a popular choice for businesses that want to streamline their sales cycles. However, Q2C should not be overlooked as it remains an integral part of the revenue generation process.

People Also Ask

What are the steps in the quote-to-cash process?

The quote-to-cash process consists of these steps:

1) Configure price quote (CPQ), which is a process of guiding the buyer through product configuration based on their specifications, determining pricing and discounting, and generating a quote.

2) Creating and sharing the sales proposal. The proposal includes the quote and additional content to help buyers reach a decision. It also includes the payment terms and contract.

3) Legal review, negotiation of the terms of the sale, and contract signature.

4) Order fulfillment based on the agreed-upon terms of the sale.

5) Invoicing and revenue recognition.

6) Payment processing.

7) Reporting and analysis to spot inefficiencies and opportunities for improvement.

8) Renewal of contracts or subscriptions.

Is order to cash the same as quote to cash?

While both terms may seem similar, they actually refer to two different processes. Order to cash (O2C) is the process of fulfilling a customer’s order, while quote to cash (Q2C) encompasses the entire sales cycle from creating a quote or estimate to receiving payment for the products or services sold.

O2C begins when an order is placed and ends when the customer pays for the goods or services received. This process includes creating invoices, processing payments, and issuing refunds or credits as needed. On the other hand, Q2C starts with generating a quote or estimate and ends when the payment is received. In between, there are a few steps, such as creating contracts, sending invoices, and collecting payments.

Is CPQ the same as quote-to-cash?

CPQ is the beginning step in the quote-to-cash process, and it sets the foundation of the deal. Generating accurate quotes in a timely manner is essential to closing sales.

What is QTC in CPQ?

Quote-to-cash (Q2C) is the entire sales cycle, from product configuration and quote generation to revenue recognition. CPQ is part of the Q2C process.

What are the three elements of quote-to-cash software?

Quote-to-cash software automates three elements of the deal process: configure-price-quote, contract management, and revenue management. When these systems are integrated, the result is a seamless quote-to-cash process.

Who owns the quote-to-cash process?

The quote-to-cash process is cross-functional and is owned by sales, legal, fulfillment, and finance. Each team owns a specific part of the process, but all departments work collaboratively to ensure revenue growth.